MFG #10: Opay/PalmPay's non-existent branding problem, Influencer Marketing & More.

Why OPay and PalmPay don't have a branding problem, how to do influencer marketing effectively, and how to reduce product friction in email verification.

Hi there.

Welcome to the 52 new subscribers that joined Marketing For Geeks since the last issue. Thanks to everyone who shares MFG with their network. Every other week, I share 1 interesting thing from my week, 3 actionable marketing insights that have helped me become a better product marketer, and 5 pieces of marketing that caught my eye.

ICYMI: In my last issue, I shared my free competitor research template and wrote about product adoption, negative personas, and product enemies:

This week, I write about why OPay and PalmPay don’t have branding problems and how to reduce friction in your email verification flow. Best of all, I have a guest insight from Web3 marketing leader, Franklin Uche, on how to use influencers effectively.

If you’re interested in contributing to MFG, check out the guest post guide.

Also, remember in the first issue of this year, I set a goal to build a community around MFG, especially for marketers who reside in Ibadan (but open to marketers everywhere). I’ve started with a small WhatsApp group — please reply to this email with your phone number or drop a comment if you’d like to join. I won’t be sharing the link publicly for now, because I want to begin with high-intent members.

It’s a lengthy issue today. Let's dive in!

🔑1 Interesting Thing

A couple weeks or so ago, someone made a tweet about losing interest in women because they use Opay or Palmpay. Amidst all the (rightful) criticism of the tweet, another tweet started gaining traction (pictured below).

I saw the tweet and it rubbed me the wrong way, but I couldn’t quite put my finger on it. Thankfully, a Twitter mutual put my thoughts into words 👇🏽

So, do brands like OPay and Palmpay have branding problems?

The easy answer is no. But let’s dig a little into why. Interestingly, the poster who made the comment about the branding problem also made my point for me without meaning to.

Part 1: Target Audience

As the original poster said (pictured above), Opay and PalmPay have grassroot audiences. They are one of the few financial solutions that have managed to penetrate rural audiences.

OPay’s parent company, Opera Group, has a well-documented history of creating products that appeal to underserved rural audiences in the informal sector. For years, its browser, Opera, was used by people whose phones didn’t have enough memory space for Chrome’s heavy memory consumption or who did not have enough internet data for Chrome’s greedy data consumption. In Ibadan, ORide (now defunct) was popular for its criminally low rates. ORide even had a special promo, if I remember correctly, that let you book a bike ride to any location in Ibadan for 20 naira on Thursdays only.

All this goes to say that for all products in Opera Group, the target audience has largely remained less-tech-savvy rural audiences. OPay is no different. PalmPay doesn’t have the same storied history that OPay has via its parent company, but its target audiences are much the same.

The complaints that the poster had about OPay and PalmPay were that their comms, positioning, approach, and design were underwhelming. By this, he meant that they did not meet a standard that appealed to him. However, as Nduka said,

“not every product must be marketed to or for the ‘upwardly mobile’ target. OPay has really strong adoption among the audience it targets”

In fact, if OPay and PalmPay were to adopt the more creative brand that I suspect the poster would prefer, they might lose some affinity with their target audience. I saw a joke on TikTok about vendors with fancy buildings and excellent etiquette and how you should run from them because they’d have high costs.

The punchline is that people will create perceptions of a brand based on how it looks. Here’s a real example. I love Abula. It’s my favourite meal, and this means I visit vendors who sell it often.

When I buy Abula from the woman at my junction who sells from the tiny shop with mismatched tiles and poor ventilation, I expect her Amala to cost about #100 per wrap and her beef to be sold at #100 per piece. Let’s call this OPay and PalmPay.

When I buy Abula from Ibadan’s infamous Amala Sky, I know I will spend at least double the amount I spend at the local vendor in my area. Let’s call this Kuda Bank (great branding that meets the standards of tech-savvy audiences).

When I see fancy restaurants that have Abula on their menu, I run away completely. I know the cost would come up to a pretty penny and I expect the taste of the Abula to be much too “refined” to actually taste good. Let’s call this GT Bank (excellent branding and brand imagery that even extends to building designs).

What many marketers try to achieve with branding is Option 3 (or 2, if they know their bosses/clients won’t let them get away with much creativity). And it can be a good thing. Great branding can help justify your pricing and present you as a more high-value brand.

However, we need to remember who the target audience is. Interestingly, the three Amala joints I mentioned have three very different target audiences (or contexts). The first Amala joint is for local traders or labourers to quickly get lunch in between work. The second is for a more upwardly mobile audience who is willing to spend a little more. The third is for wealthier audiences who care more about factors like ambience than about cost.

Great branding does not just justify your pricing, it signifies and hints at it to your customers. So when you create a product that is supposed to be for rural audiences, you cannot have branding that makes them perceive you as a higher-end brand.

OPay and PalmPay may decide to undergo a rebrand in the future, but, unless they change or expand their target audience, it will likely still not be one the poster would find impressive. As the poster said, “nothing is ‘wrong’…they have a more grassroots audience.”

Part 2: Branding Goals

Sadly, among many marketers, branding has become more about posturing than anything. It’s a trap I’ve fallen into myself in the past. We want people to ooou and aah when they see our work. We want to win awards. We want to brag to people that yes, we did that. And great branding does just that, undeniably. But great branding is also about a host of other things. So, I did a quick Google Search on the top benefits of great branding. These were the top 5 benefits:

Brand Recognition

Brand Trust & Credibility

Customer Loyalty

Brand Consistency

Competitive Advantage

Here’s the interesting thing. Both OPay and PalmPay have largely attained these goals. We’ll look through them one by one.

Brand Recognition: There’s a running joke about PalmPay on social media. The joke is about the lengths PalmPay agents are willing to go to recover debts from loan defaulters. On TikTok videos, skit-makers wear purple t-shirts to play-act the role of PalmPay agents. It’s almost always the same shade of purple in these videos. Everyone knows what the PalmPay purple looks like. That’s brand recognition.

When I first heard about OPay, I immediately knew it was affiliated with Opera (OPay’s parent company). It’s a cute thing Opera does with all products in its house of brands — products like OPay, OKash, OWealth, and the now-defunct ORide, OFood, and OCar. That’s brand recognition.

Brand Trust & Credibility: I’ve heard multiple vendors say different variations of statements about how they are almost 100% certain that transactions done to OPay or PalmPay accounts will go through. It’s why OPay and PalmPay enjoyed high growth during Nigeria’s cash scarcity. People trusted OPay and PalmPay so much that they drove signups via word of mouth. I’ve had a vendor ask me why I don’t use OPay before and recommend that I switch to it. That’s the highest level of brand trust for me.

Customer Loyalty: Many of the points about brand trust for OPay and PalmPay also apply to customer loyalty. If you don’t believe OPay or PalmPay have brand loyalty, try convincing your local vendor to switch from them.

Brand Consistency: At the most basic level, brand consistency is easy. As long as Opera keeps naming their products with the O- prefix and PalmPay keeps using their purple t-shirts, they have some level of brand consistency, enough that no one has an issue with it.

The visual part of brand consistency is easy enough that most companies achieve it without thought. It’s simple things like the brand colours or brand logo. The thing about brand consistency is that it is only difficult to manage when you have a more complex and highly defined brand. When you have a simple brand with basic visual assets and an undefined brand voice, brand consistency is as simple as using the right brand colours and logo.

Competitive Advantage: Many brand experts will tell you that great branding helps you stand out in a saturated market. This is very true. However, branding isn’t the only way to stand out from competitors. Fintech in Nigeria has a widespread reputation for being oversaturated. Yet OPay and PalmPay are clear of their competitors.

The truth is that you cannot lean on branding alone to make you stand out from the competition. It is only when you have a product that has no differentiator from others that you have to lean on branding as a last-ditch effort to put you over the top. However, when you have an excellent product that gets the job done better than all its competitors (like OPay and PalmPay do), then you don’t need to use branding as a lever to stand out — your product stands out on its own.

At the end of the day, a great product that serves its target audience well will always win over a great brand. For all of GTBank’s creative ads, interesting building designs, and lively events, it is losing customers to the likes of OPay and PalmPay.

TL;DR (Too Long, Didn’t Read): Great branding is not about out-of-the-box creative designs and brand voice. Great branding starts with an understanding of your target audience and what appeals to them or turns them off. More than that though, great branding can never take the place of a great product.

💭3 Insights

#1. Verification codes add more friction in your user journey.

When new users sign up to use a product, there are 2 ways by which you could verify that their email address or phone number is accurate — verification code or verification link.

This verification is important to validate contact information, weed out bots, and check deliverability. However, it can also become a leak in your funnel (the average drop-off rate for verification/confirmation emails is 10-25%). Verification is, by design, a friction point for users. This is why you must do whatever you can to ease the level of friction users face at this stage.

I recently expressed my frustration with verification codes to a colleague and I’ll share them here as well. Verification codes are very high friction for me, especially when I use a mobile device. Here’s what the user journey for verification code typically looks like on mobile devices:

Request code → Open email app → Copy code → Close email/SMS app → Open intended app → Paste code → Press enter

OR

Request code → See/hear code from message notification/call → Memorise code → Type code → Press enter

In the worst-case scenario, I have to go through at least 7 different steps just to verify my email or phone number. In the best-case scenario, it’s 5 steps + code memorisation. Even worse, there’s a chance the code submission page might have reloaded by the time I get back from opening my email or SMS app, which would mean I’d have to request another code and undergo the painful process all over again.

By contrast, here’s the user journey for verification links:

Request link → Open email/SMS app → Click link

Only three steps and email verification is automatic. It’s pretty clear why it’s my preferred verification method. It eases friction drastically and improves the experience, especially for mobile users.

Update (March 23, 2024): While verification codes can still be high friction, many mobile OS now automatically pull codes from your SMS and paste in the verification field. However, this is not the case with all devices and verification codes still act as friction points for some users.

TL;DR: Verification codes can be high-friction, especially for mobile users. Use verification links instead, which have low friction and a more seamless journey.

#2. An “Open Email” button can ease the user’s journey.

Speaking of email verification, you can further ease verification friction, by adding an “Open Email” button on the verification page — you know, the page where you tell them “we’ve sent a verification link to your email. check spam if you can’t see it.”

That way, people don’t have to close your app and go open their email app (an added friction point). Instead, they simply click the “Open Email” button and their email provider will automatically open to the exact verification email you sent to them. This reduces the chance of them missing your email in the sea of other emails they receive and drastically improves the level of product friction.

One of my favourite websites, Growth.design, uses this technique and they have a super-helpful post about how to use sniper links to improve this experience even further.

TL;DR: Adding an “Open Email” button to your verification page will help ease product friction and improve your verification rates. Want better results? Use a sniper link.

#3. Showing, rather than telling, is key in influencer marketing.

Insight from Franklin Uche, a Web3 marketing leader who has spent the last 4 years pushing blockchain adoption. Franklin also authors a newsletter on Web3 marketing and takes walks with his dog in his free time. The rest of this section (Insight #3) is written from Frank’s POV.

Using influencers is very tricky, especially in Web3. In 2020/2021, crypto influencers were pushing different types of projects without discretion, and a number of those projects either died or turned out to be scams. So, Web3 influencers don’t have as much trust as they did a few years ago.

When you’re using influencers, the best strategy is to have them show the value of your project, rather than sell it. This was a strategy GMX (an on-chain trading platform) used in their early days. GMX didn’t use influencers in the normal way where influencers tell their followers “come and use GMX, GMX is great”. Instead, they got influencer traders to use the platform and share their PnL and referral codes. Then the influencers would use captions like “I’m up 10% on my bitcoin trade from yesterday on GMX”. So, the influencers were actually using the product and sharing real-life value they were getting from using it.

This strategy was very effective. One of their influencers posted a screenshot showing he had made close to $100k from GMX referrals alone. I might have even started using GMX because of him, but I was working on a similar project at the time. GMX went on to become the market leader in the PerpDex space.

There are two reasons why this “show, don’t tell” strategy was so successful for GMX:

They had a great product and solved a specific problem many traders had.

Their influencers got revenue-share referral rewards and many had even invested in GMX early. This means they had skin in the game. They had a reason to keep pushing the product aggressively. If you get influencers who have some buy-in to your product, they’ll be more incentivised to spread the word.

TL;DR: When using influencers, get them to use your product and show the value they received from using the product. It is much better to get people to trust influencers when the influencers can show them the value, rather than tell them about it.

⚡5 Pieces of Marketing

#1. This micro-copy from Miro👍🏽

Excellent hero section. Most striking thing is the micro-copy circled in red — “keep work and life separate by using your work email.”

x

#2. This cancellation page by Skillshare👍🏽

Love how personalised this page is. They remind me of value I’d be losing, they point out I still have a few free days that I’d be losing if I cancel early, and they don’t disguise the actual cancellation button.

#3. Skillshare’s extended trial👍🏽

Remember in MFG #07, where I wrote about how you can delight customers by presenting free offers as add-ons?

Well, this is an excellent example. Skillshare gave me an extra month for free to disincentivise me from cancelling.

P.S. I took the free month and I am seriously considering paying for a membership.

#4. Growth.design’s “Secret Slides”👍🏽

For context, I saw this slide because I kept scrolling after viewing one of Growth.design’s case studies. It’s a slide that essentially asks you to leave a comment on LinkedIn. Love how they position this as a “secret slide” and give you a nudge to what topic your comment could be about.

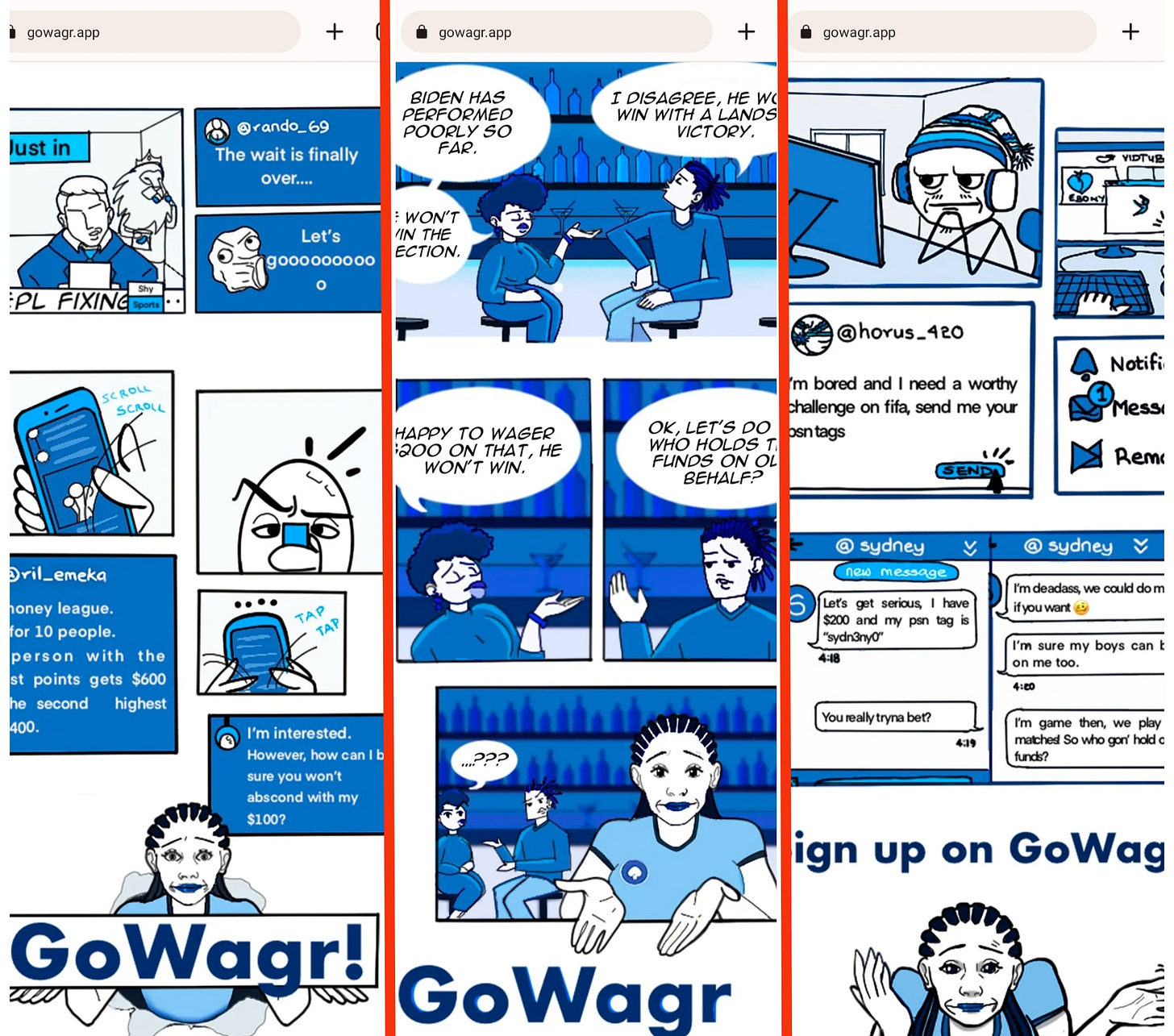

#5. Gowagr’s Website👍🏽

A masterclass in storytelling. Only objection is that it doesn’t look great on desktop.

What I’m Reading

Notes on Superhuman’s Acquisition Loops — Tells the very interesting story of how Superhuman creates acquisition loops. Lessons on how to build virality and growth loops in your product.

Your guide to self-serve onboarding — Top 7 self-serve onboarding mistakes and how to fix them.

Feature-Audience Mismatch — Insightful article about how to create bottom-of-the-funnel content that your audience will actually find useful.

Lemme be factual.

This is amazing, I read from beginning to the end.

Didn't even appear long.

Thanks to Adora for sharing on her status.

This is such an insightful piece. This whole Opay and Palmpay “branding issue” is lowkey rooted in classism. Their target audience doesn’t fit into people’s “ideal” expectations.